Description

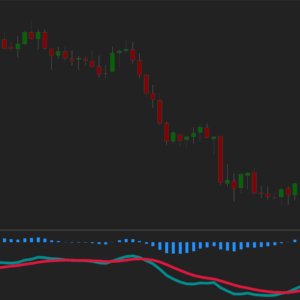

A momentum-based reversal system built on the classic Stochastic oscillator.

The Stochastic Overbought/Oversold Strategy looks for potential market reversals by identifying when momentum becomes stretched in either direction. A sell signal appears when the Stochastic oscillator indicates overbought conditions, while a buy signal forms when the market moves into oversold territory. This makes the strategy suitable for traders who prefer clear, momentum-based turning points.

Sensitivity and smoothing are fully configurable, allowing you to tune how quickly or conservatively the Stochastic reacts across different markets and timeframes.

How to use

On the first use, paste you license code into the License field in strategy parameters.

- Set the PeriodK — this controls the primary sensitivity of the oscillator.

- Adjust the PeriodD to define how much smoothing is applied to the signal line.

- Configure the Smooth value to apply additional smoothing for cleaner signals.

- Define your Overbought and Oversold thresholds to set reversal zones.

- Choose the entry mode (Limit or Market) and configure your preferred risk settings.

- Enable optional modules such as profit targets, stop losses, plots, or color settings.

- Run backtests or live trading – the strategy executes and manages trades automatically.

Indicator Parameters

| Parameter | Description |

|---|---|

| PeriodK | Defines how fast the Stochastic reacts to price changes. Smaller = very reactive, more signals.Larger = slower, more stable. |

| PeriodD | Applies smoothing to the raw K line. Higher values filter noise but make turning points slower. |

| Smooth | Applies additional smoothing to the Stochastic calculation. Higher values create the cleanest, most stable curve, but with the most delay. |

Trading Parameters

| Parameter | Description |

|---|---|

| Trading | Entry Type | Market = fastest execution. Limit = controlled entry at your price. |

| Trading | Profit Target | Locks in gains at your chosen distance. Optional. Supports Limit and MarketIfTouched. |

| Trading | Stop Loss | Manages downside risk. Optional. Stop – standard exit. Simulated-StopLoss – helps avoid poor fills in thin markets. |

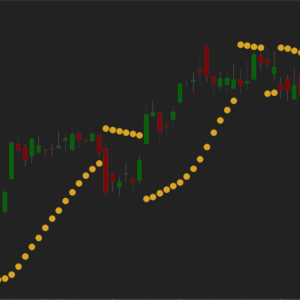

| Additional | Show or hide MA lines on the chart, fully customizable for clean visual workflow. |