Description

A straightforward, rule-driven system built on classic RSI reversal logic.

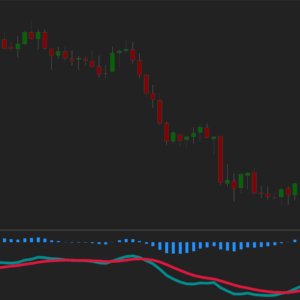

The strategy detects stretched momentum conditions using the Relative Strength Index (RSI). When RSI rises into overbought levels, it can signal exhaustion and a potential short setup; when it falls into oversold territory, it often marks a long opportunity.

Our implementation keeps the concept simple but fully configurable, allowing you to tune RSI sensitivity and threshold levels to match your trading style and market.

How to use

On the first use, paste you license code into the License field in strategy parameters.

- Select the RSI period — this defines how sensitive the indicator is to recent price movement.

- Set your overbought and oversold thresholds to determine when reversal signals should trigger.

- Choose the entry mode (Limit or Market) and configure your preferred risk settings.

- Enable optional modules such as profit targets, stop losses, plots, or color settings.

- Run backtests or live trading – the strategy executes and manages trades automatically.

Indicator Parameters

| Parameter | Description |

|---|---|

| RSI – Period | Smaller period = aggressive signals, more noise. Bigger period = conservative signals. |

| RSI Upper – Value | Smaller value = More signals, more sensitive to momentum peaks. Works better with larger RSI periods. Bigger value = fewer signals, only extreme overbought conditions trigger signals. Works well with small RSI periods to cut noise. |

| RSI Lower – Value | Smaller value = fewer entries — only deep oversold conditions. Best paired with fast RSI to avoid endless signals. Bigger value = more entries, mild dips trigger signals. Best paired with slow RSI for balanced behavior. |

Trading Parameters

| Parameter | Description |

|---|---|

| Trading | Entry Type | Market = fastest execution. Limit = controlled entry at your price. |

| Trading | Profit Target | Locks in gains at your chosen distance. Optional. Supports Limit and MarketIfTouched. |

| Trading | Stop Loss | Manages downside risk. Optional. Stop – standard exit. Simulated-StopLoss – helps avoid poor fills in thin markets. |

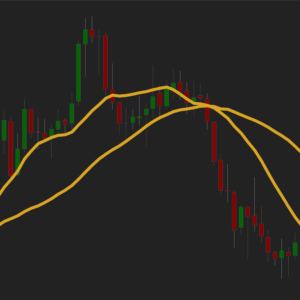

| Additional | Show or hide MA lines on the chart, fully customizable for clean visual workflow. |